Debt consolidation has become an increasingly popular financial strategy for managing multiple debts efficiently. By combining several high-interest debts into a single loan with a potentially lower interest rate, borrowers aim to simplify repayment and reduce their overall financial burden. However, deciding whether to consolidate your debt with a loan requires a thorough understanding of the benefits, risks, and key considerations involved.

This detailed article explores everything you need to know to make an informed decision about debt consolidation loans.

What is Debt Consolidation?

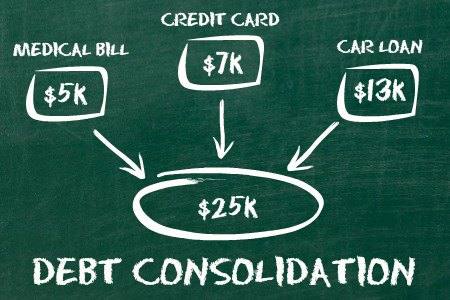

Debt consolidation involves taking out a new loan to pay off multiple existing debts such as credit cards, personal loans, or medical bills. Instead of juggling multiple monthly payments, borrowers have one consolidated loan with a single monthly payment.

Types of debt consolidation loans include:

- Personal loans

- Home equity loans or lines of credit (HELOC)

- Balance transfer credit cards

Advantages of Consolidating Debt with a Loan

1. Simplified Finances

Managing one monthly payment instead of several reduces stress and lowers the risk of missing payments. Simplified budgeting makes it easier to stay on top of your finances.

2. Potentially Lower Interest Rates

If you qualify for a debt consolidation loan with an interest rate lower than your current debts (especially credit cards), you could save money on interest over time.

3. Fixed Repayment Schedule

Debt consolidation loans usually come with fixed terms and monthly payments, providing a clear roadmap to becoming debt-free.

4. Improve Credit Score Over Time

Timely payments on a consolidation loan can positively impact your credit score by reducing your credit utilization and demonstrating responsible repayment behavior.

5. Avoid Multiple Fees

Consolidating debts can help eliminate various fees like late payment penalties or annual credit card fees.

Potential Drawbacks of Debt Consolidation Loans

1. Possible Longer Repayment Period

While monthly payments may be lower, extending the loan term could result in paying more interest over time.

2. Risk of Accumulating More Debt

Consolidation can sometimes create a false sense of financial freedom, tempting some borrowers to rack up new debt on cleared credit cards.

3. Upfront Fees and Costs

Some consolidation loans have origination fees, closing costs, or balance transfer fees, which can add to the overall cost.

4. Collateral Risk for Secured Loans

Home equity loans or lines of credit are secured by your property. Failure to repay could lead to foreclosure.

5. Does Not Address Underlying Spending Habits

Without budgeting discipline, debt consolidation merely rearranges debt and does not solve root financial issues.

Who Should Consider Debt Consolidation?

- Individuals juggling multiple high-interest debts, especially credit cards.

- Borrowers who can qualify for a loan with a lower interest rate than their current debts.

- Those committed to avoiding new debt during the repayment period.

- People who prefer the simplicity of one monthly payment and fixed payoff schedule.

- Borrowers with a stable income and good credit to secure favorable loan terms.

When Debt Consolidation Might Not Be Right

- If you have poor credit and cannot access a loan with reasonable rates.

- When your debts are low or manageable without consolidation.

- If you lack a clear budget or plan to prevent future debt.

- When fees and costs of consolidation outweigh the benefits.

Steps to Successfully Consolidate Your Debt

1. Evaluate Your Debts and Financial Situation

List all outstanding debts, interest rates, monthly payments, and balances. Calculate your total debt and monthly obligations.

2. Shop Around for the Best Loan Terms

Compare interest rates, fees, loan amounts, and repayment terms from multiple lenders to find the most cost-effective option.

3. Avoid Applying for Too Many Loans

Multiple loan inquiries can temporarily lower your credit score. Choose lenders carefully.

4. Create a Realistic Budget

Ensure you can afford the new monthly payment and avoid accumulating new debt.

5. Use the Loan to Pay Off All Existing Debts

Apply the consolidated loan proceeds to pay off all targeted debts immediately.

6. Stick to Your Repayment Plan

Make timely payments and monitor your progress to avoid falling back into debt.

Alternative Debt Management Options

If debt consolidation isn’t a perfect fit, consider other options such as:

- Debt management plans through credit counseling

- Negotiating directly with creditors for reduced interest or settlements

- Bankruptcy (as a last resort)

- Balance transfer credit cards (for those with good credit)

Conclusion

Consolidating your debt with a loan can be a powerful tool to simplify payments, reduce interest costs, and accelerate debt payoff. However, it is not a one-size-fits-all solution. Careful evaluation of your financial situation, loan options, and spending habits is critical to ensuring that consolidation helps rather than harms your long-term financial health.